Geothermal Tax Credits Extended Through 2032

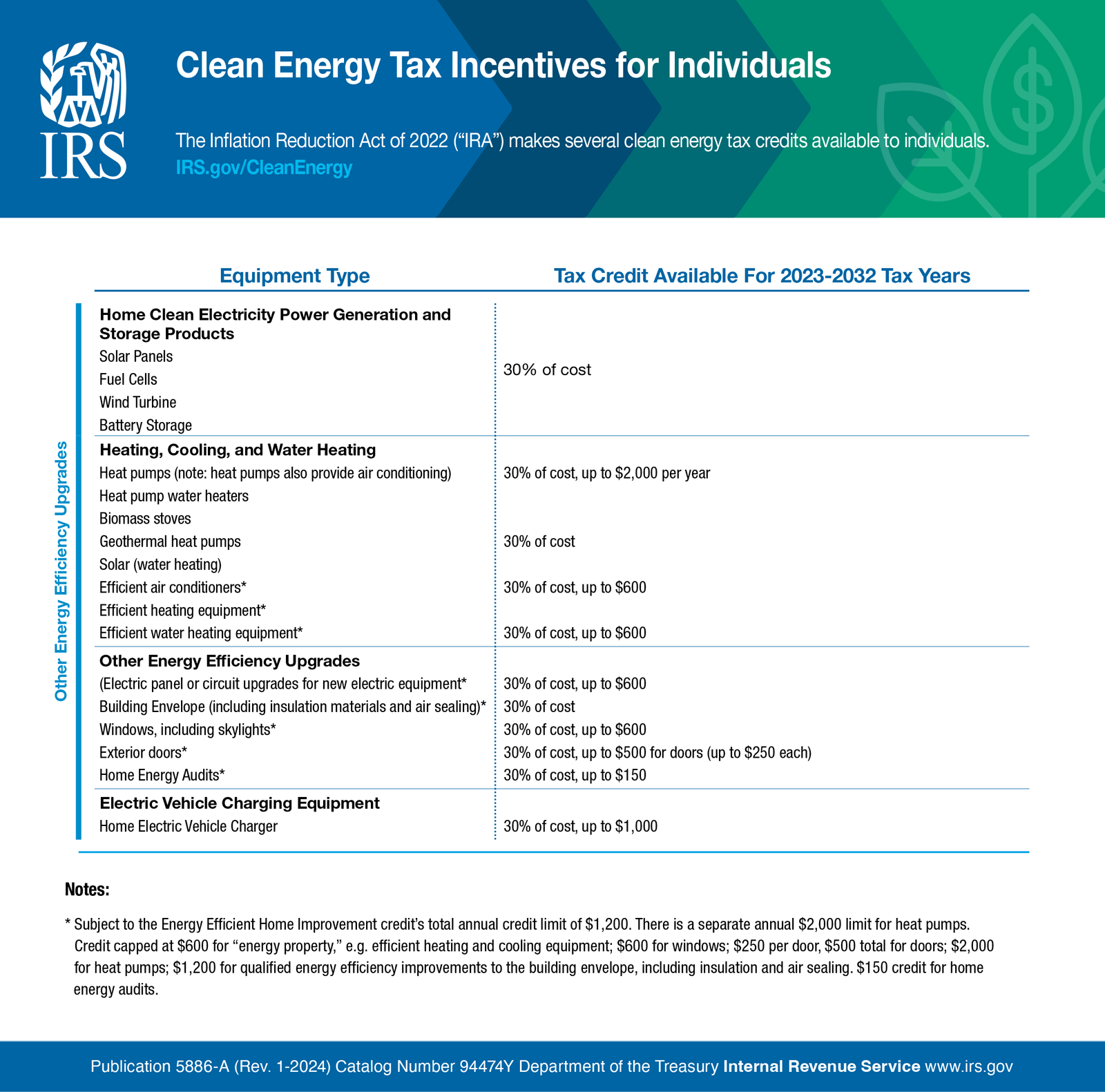

All Weather Heating & Cooling is able to provide qualified energy-efficient improvements so you can save some $$$ this year. The IRS allows for the following:

“If you make qualified energy-efficient improvements to your home after Jan. 1, 2023, you may qualify for a tax credit up to $3,200. You can claim the credit for improvements made through 2032.”

Beginning Jan. 1, 2023, the credit equals 30% of certain qualified expenses, including:

- Qualified energy efficiency improvements installed during the year

- Residential energy property expenses

- Home energy audits

There are limits on the allowable annual credit and on the amount of credit for certain types of qualified expenses. The credit is allowed for qualifying property placed in service on or after Jan. 1, 2023, and before Jan. 1, 2033.

The maximum credit you can claim each year is:

- $1,200 for energy property costs and certain energy efficient home improvements, with limits on doors ($250 per door and $500 total), windows ($600) and home energy audits ($150)

- $2,000 per year for qualified heat pumps, biomass stoves or biomass boilers

The credit has no lifetime dollar limit. You can claim the maximum annual credit every year that you make eligible improvements until 2033.

The credit is nonrefundable, so you can’t get back more on the credit than you owe in taxes. You can’t apply any excess credit to future tax years.

Residential Energy Property

Residential energy property that meets the Consortium for Energy Efficiency (CEE) highest efficiency tier, not including any advanced tier, in effect at the beginning of the year when the property is installed qualifies for a credit up to $600 per item. Costs may include labor for installation.

Qualified property includes new:

- Central air conditioners

- Natural gas, propane, or oil water heaters

- Natural gas, propane, or oil furnaces and hot water boilers

Oil furnaces or hot water boilers can also qualify through other efficiency criteria.

Costs of electrical components needed to support residential energy property, including panelboards, sub-panelboards, branch circuits, and feeders, also qualify for the credit if they meet the National Electric Code and have a capacity of 200 amps or more. There is a limit of $600 per item.

Heat pumps and biomass stoves and boilers

Heat pumps and biomass stoves and boilers with a thermal efficiency rating of at least 75% qualify for a credit up to $2,000 per year. Costs may include labor for installation.

Qualified improvements include new:

- Electric or natural gas heat pumps

- Electric or natural gas heat pump water heaters

- Biomass stoves and boilers”